Find the Right Mortgage Broker San Francisco for Your Specific Financing Requirements

Find the Right Mortgage Broker San Francisco for Your Specific Financing Requirements

Blog Article

Discover the Significance of Employing a Professional Home Mortgage Broker for Your Home Purchase

Knowledge in Home Mortgage Choices

Navigating the complex landscape of home mortgage choices requires not just understanding yet also a nuanced understanding of the monetary market. An expert home loan broker brings necessary know-how that can considerably boost the home-buying experience. These experts are well-versed in the myriad sorts of home loan items available, including fixed-rate, adjustable-rate, and specialized car loans like FHA or VA home mortgages. Their thorough understanding allows them to identify the finest options tailored to specific financial circumstances.

Moreover, home loan brokers stay upgraded on dominating market fads and rate of interest prices, enabling them to provide educated suggestions. They can analyze clients' financial accounts and help in establishing qualification, calculating potential regular monthly repayments, and contrasting general costs connected with various home loan products. This degree of understanding can be very useful, especially for newbie buyers who might feel overwhelmed by the alternatives offered.

Furthermore, a home loan broker can aid customers navigate the intricacies of lending terms, costs, and possible pitfalls, making certain that consumers make well-informed decisions. By leveraging their knowledge, buyers boost their possibilities of protecting positive home loan conditions, ultimately causing an extra economically sound and successful home purchase.

Accessibility to Multiple Lenders

Accessibility to numerous lending institutions is among the essential advantages of dealing with a specialist home mortgage broker. Unlike individual consumers that may only think about a limited number of financing options, mortgage brokers have developed relationships with a large array of loan providers, consisting of banks, lending institution, and alternate funding resources. This considerable network allows brokers to access a diverse series of financing items and rate of interest tailored to the specific demands of their clients.

By presenting multiple funding choices, home mortgage brokers equip customers to make informed decisions. They can compare various terms, rate of interest, and settlement plans, guaranteeing that customers discover the finest fit for their monetary situation. This is particularly helpful in a changing market where conditions can differ significantly from one lender to one more.

Additionally, brokers commonly have insights right into special programs and incentives that may not be widely promoted. This can result in potential cost savings and far better loan conditions for customers, eventually making the home purchasing process much more reliable and cost-efficient. In summary, accessibility to multiple lenders with a professional home mortgage broker improves the loaning experience by supplying a wider choice of financing alternatives and fostering educated decision-making.

Personalized Financial Guidance

A professional home loan broker gives individualized economic advice that is tailored to the specific needs and situations of each borrower. By evaluating a customer's monetary situation, consisting of revenue, debt history, and long-term goals, a broker can offer insights and suggestions that align with the debtor's unique profile. This bespoke technique makes certain that clients are not simply presented with common alternatives, yet instead with customized home mortgage remedies that fit their details demands.

Additionally, brokers possess comprehensive understanding of read the full info here numerous funding products and current market patterns, enabling them to educate clients regarding the advantages and drawbacks of different official website funding options. This advice is vital for consumers that might feel overwhelmed by the complexity of home mortgage choices.

Along with navigating via various loaning criteria, a home mortgage broker can assist customers understand the effects of various car loan terms, prices, and associated prices - mortgage broker san Francisco. This quality is important in equipping borrowers to make educated decisions that can considerably affect their financial future. Eventually, individualized economic support from a mortgage broker fosters confidence and comfort, ensuring that clients feel sustained throughout the home-buying process

Time and Expense Savings

In enhancement to supplying tailored monetary assistance, a specialist mortgage broker can significantly conserve customers both time and cash throughout the mortgage process. Browsing the intricacies of mortgage choices can be frustrating, specifically for new homebuyers. A competent broker streamlines this procedure by leveraging their industry knowledge and links to recognize the most effective mortgage items readily available.

In regards to expense financial savings, home mortgage brokers frequently have accessibility to find out this here special finance programs and reduced passion rates that may not be available to the public. Their arrangement abilities can cause better terms, inevitably saving customers thousands over the life of the loan. In addition, brokers can aid customers avoid expensive blunders, such as selecting the wrong home loan kind or ignoring hidden charges. In general, utilizing a specialist home mortgage broker is a sensible financial investment that translates to significant time and monetary benefits for homebuyers.

Stress Reduction Throughout Process

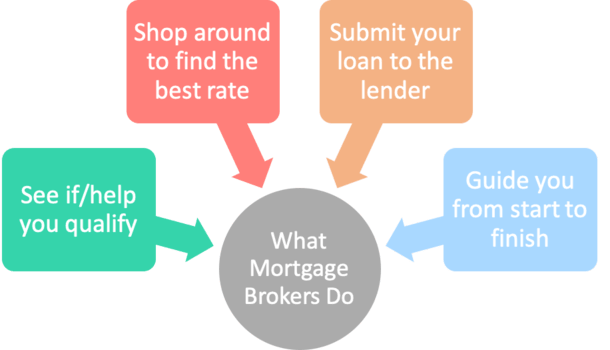

Just how can homebuyers browse the usually stressful journey of obtaining a home loan with better ease? Involving a professional home mortgage broker can substantially relieve this stress and anxiety. These specialists recognize the complexities of the home loan landscape and can guide customers through each phase of the procedure, guaranteeing that they remain enlightened and positive in their decisions.

A mortgage broker functions as an intermediary, streamlining communication in between buyers and lenders. They manage the documentation and target dates, which can typically really feel overwhelming. By tackling these duties, brokers enable buyers to concentrate on other essential aspects of their home acquisition, reducing overall tension.

Furthermore, home loan brokers possess comprehensive expertise of various car loan products and market conditions. This insight allows them to match buyers with the most appropriate options, minimizing the moment spent looking through unsuitable deals. They additionally offer individualized recommendations, helping clients established reasonable expectations and prevent common challenges.

Eventually, employing an expert mortgage broker not just streamlines the home mortgage process but likewise boosts the homebuying experience. With specialist support, property buyers can approach this essential economic decision with better assurance, ensuring a smoother transition right into homeownership.

Final Thought

In conclusion, the benefits of working with a specialist home loan broker dramatically improve the homebuying experience. Engaging a home mortgage broker inevitably leads to a much more effective and effective home acquisition journey.

These specialists are skilled in the myriad types of home loan products offered, including fixed-rate, adjustable-rate, and specialty finances like FHA or VA home loans.A specialist home mortgage broker provides individualized financial support that is tailored to the specific needs and scenarios of each debtor. Eventually, customized economic advice from a home loan broker fosters self-confidence and peace of mind, guaranteeing that clients feel supported throughout the home-buying procedure.

In enhancement to offering personalized monetary assistance, an expert mortgage broker can substantially conserve clients both time and money throughout the home loan procedure. Overall, utilizing an expert home loan broker is a sensible investment that equates to considerable time and financial benefits for homebuyers.

Report this page